In a speech at the Labour National Conference today, John McDonnell, Shadow Chancellor, announced:

“It’s not just students and households with credit cards who are being ripped off. The scandal of the Private Finance Initiative, launched by John Major, has resulted in huge, long-term costs for tax payers, whilst handing out enormous profits for some companies. Profits which are coming out of the budgets of our public services.

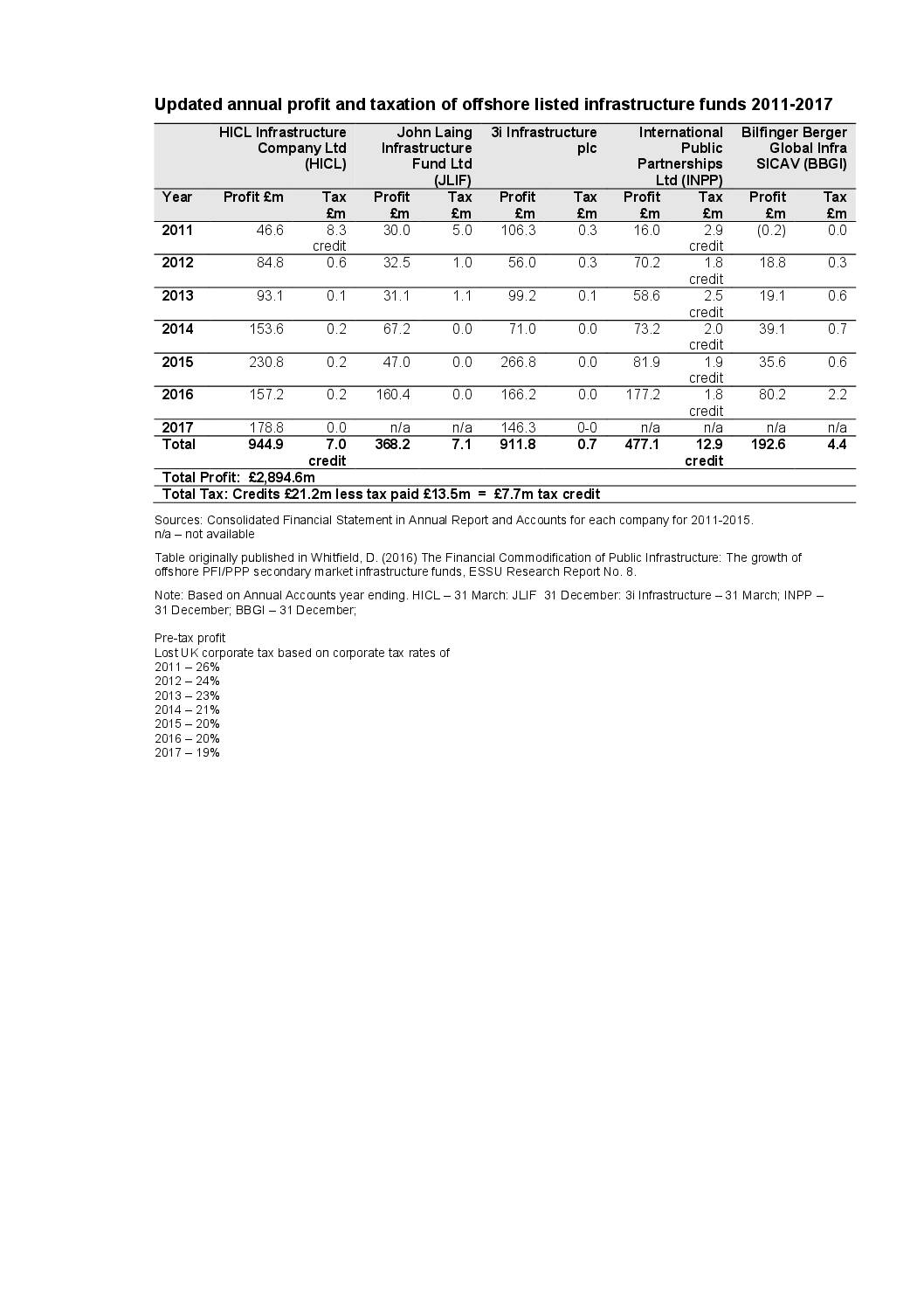

Over the next few decades, nearly two hundred billion is scheduled to be paid out of public sector budgets in PFI deals. In the NHS alone, £831m in pre-tax profits have been made over the past six years. As early as 2002 this conference regretted the use of PFI.

Jeremy Corbyn has made it clear that, under his leadership, never again will this waste of taxpayer money be used to subsidise the profits of shareholders, often based in offshore tax havens. The government could intervene immediately to ensure that companies in tax havens can’t own shares in PFI companies, and their profits aren’t hidden from HMRC.

We’ll put an end to this scandal and reduce the cost to the taxpayers. How? We have already pledged that there will be no new PFI deals signed by us. But we will go further. I can tell you today, it’s what you’ve been calling for.

We’ll bring existing PFI contracts back in-house.”

Labour Press Notice, 25 September 2017

Labour today commits to signing no new PFI deals, to look to bring existing contracts back in-house and to develop alternative public sector models for funding infrastructure, saving the public money and improving services and working conditions. Labour will review all PFI contracts and, if necessary, take over outstanding contracts and bring them back in-house, while ensuring NHS trusts, local councils and others do not lose out, and there is no detriment to services or staff. On top of the billions of pounds paid out to shareholders, an estimated £28bn is being lost through costs incurred by problems associated with PFI, including higher interest rates, bail outs and management fees.

A Labour Briefing contained further details:

1. Review, in conjunction with local authorities, NHS Trusts and other public bodies, all PFI contracts to assess the SPVs’ performance on:

– safety, including fire risk, in PFI buildings;

– labour and equalities impacts, and wages;

– changes in equity ownership;

– quality of delivery on service and construction contracts.

2. Consult on amending or repealing legislation which provides government underwriting of unitary payments to PFI companies whilst ensuring the sustainability of public sector budgets reliant upon previous forms of PFI credits and payments. Existing PFI schemes were supposed to remove risk from the public sector but have failed to do so.

3. Consult on appropriate methods for returning the ownership and responsibilities of SPVs [special purpose vehicles] to the public sector, with shares-for-bonds nationalisation (via an Act of Parliament) the presumed preferred approach. Shares held in countries deemed tax havens may be compensated at a different rate from others. Differential compensation rates for equity held by pension funds will also be considered.

4. Ownership of assets and responsibilities for services will be returned to the bodies who have been paying for them, and who no longer need to make unitary payments.

5. Develop a new public sector design/construction model based on public investment that enhances public sector capabilities to plan, design, manage and operate public infrastructure. Examples we will consider include the USA’s construction management at-risk. Our intention is not just to take over existing assets but to build the capacity to deliver projects better in future.

6. Enshrine the rights of staff to have rights kept or enhanced to comparable public sector standards on transfer to public sector bodies.

7. End the UK government’s financial and advisory support for similar projects overseas.